Fix the Tax Mess Part 2 – Let’s Optimize, Simplify and Grow Individual Tax Revenues

Article #14 Purple Wayz: Navigating to the Center

Been a coupla weeks. Needed the break!

In the last PW article, we touched on the 10 Myths of Taxes and a broad overview of how the US could reform its tax system. We could raise more taxes while making it simpler, with better incentives. Huh? Yep, totally doable. It’s just that political will thing getting in the way again. We’ve said many times that the Trump Administration will not deal with this. They want to extend the 2017 Tax Act with some added ‘bennies. So this task will fall to future Presidents and Congresses.

Today, we talk about the biggest part of this pie–INDIVIDUAL INCOME TAXES. Everyone’s favorite topic.

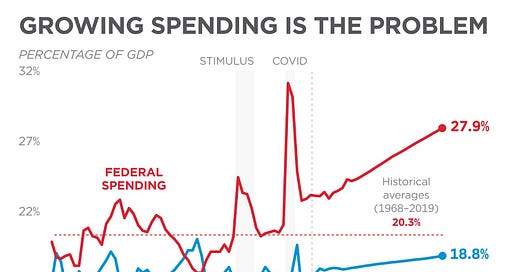

Refresher Over time, tax revenue has hovered around 17% of GDP regardless of tax rates while spending has gone from 18% of GDP in the 1970s to 23% and rising in the 2020s. This is important context as we discuss tackling the deficit issue. First, spending is the majority of the problem. Second, it’s REALLY hard to move tax revenues much over 17.5% of GDP. This is because taxes are dynamic. When you tax something, you get less of it. If you don’t believe this, please (re)read the prior article on the Top 10 Tax Myths. As a nation, we have been misled on the tax topic for years.

We’re already progressive The US took in $2.1 trillion in individual income tax revenue in 2022. This was approximately 51% of all federal tax revenue. The chart below shows the breakdown in various income categories–the top 5% of earners paid 61% of the total individual income taxes in 2022, and that has been the average since 2010. Contrary to many people’s beliefs, the US has one of the most progressive tax systems in the world. This is largely because we don’t levy Value Added Taxes, popular in Europe, which tend to be more regressive.

TJCA was too good for taxpayers In 2017, the Trump’s Tax Cuts and Jobs Act (TJCA) cut taxes and lowered rates for all Americans. As you can see in the first chart above, they didn’t fully ‘pay for themselves’ as total tax revenues dipped below the long term baseline of 17% of GDP in the late 2010s. Contrary to popular belief, the benefits of the TJCA were spread among income groups. The highest quintile got the best deal (2% better), and the middle 3 quintiles did pretty well too (1-1.5% better). The lowest quintile doesn’t pay taxes, but is now receiving more, so that group improved nicely also. In the chart below, you can see that the middle quintiles benefited mainly through the higher standard deduction, which was raised to $24,000 for joint returns. And higher income groups benefited mainly through lower tax rates. Everyone had offsets, too. Middle quintiles had to deal with the deletion of the personal exemption. Highest quintile could only write off $10K maximum in their state and local taxes. Here’s what it would look like in 2026 (8 years later) with no changes.

In these charts, you can start to conclude where things need to go. For the top quintile, fewer loopholes would be the major improvement. You could probably raise the highest tax rate 2-3% too, but that’s a slippery slope. Historically, when you do this, the tax base erodes, and you get the same tax revenue with worse incentives for growth. Also, the third and fourth quintiles probably overshot on the size of the new standard deduction. If you make $150,000, you benefited incredibly from the increase from $13k to $24k. That’s $11k less taxable income at 25% rate--you saved $2.8K in taxes. Finally, we could raise a TON of money by doing away with a multitude of special tax deals.

Here’s a Centrist Solution

Cap itemized deductions: The top 3 deductions are charitable giving, mortgage interest, and state and local taxes. Don’t abolish these. Just cap them. TJCA capped SALT at $10k. That was very effective for raising tax revenue from itemizers. Cap the whole thing at $20k, then index to inflation. Congress won’t have to abolish all the cherished loopholes, which is a political nightmare. Right now only 9% of taxpayers are itemizers. Two thirds of these people are high earners–over $500k. So this only gets you so far. This would raise in the $80-100 billion per year range.

Raise the highest tax rate by 2-3% and others by 1%. If you combine the itemized deductions with a small tax rate increase, you’d raise another $50-70 billion/year for the top quintile. This is small enough not to change behavior. These two changes together for the top earners gets you halfway to our PW $400 billion annual goal. For the middle quintiles, a 1% tax rate increase raises approximately $30-40 billion/year. Great, but still a lot to do.

Reduce the standard deduction from current $28k to $18k, then index to inflation. As mentioned, this overshot and provided too juicy of a tax cut to the middle income crowd. The top 10% of earners in 2022 had ~49% of total AGI in the US. And the next 40% of earners had ~40% of AGI. As mentioned in the last article, you can’t raise enough tax revenue to solve the deficit issues without gaining more tax revenue from this crowd. This move would yield about $80-100 billion of additional tax revenue per year.

LOTS AND LOTS OF SPECIAL DEALS: More than can be listed here. If you’re curious, please go to the Committee for a Responsible Federal Budget website and look at all their options. It’s stunning. As mentioned in the last article, I like their idea of limiting the employer-based healthcare exemption to the 50th percentile of premiums. If I ever get around to writing about our screwed up healthcare system, this tax distortion will be close to or at the top of the list. Together, all the moves above would get us to about $325-350 billion/year. The rest would come from Social Security, Corporate Taxes, and other taxes, which we’ll cover in the next article.

Simplicity, Simplicity, Simplicity. My favorite quote from 1800s philosopher Henry David Thoreau. We can do all of the above and still get to our goal of limiting the number of returns that have to be filled out. Once someone checks the box that they are not itemizing, they’re done.

That was easy, right? No way. Each tax increase mentioned in this article equates to thousands or millions of incredibly angry people who will vote the proposer out of office. We’re back to political will again. Who will stick their neck out and go first? A two party Duopoly isn’t designed to handle this problem. We have to change it with state-by-state electoral reforms that can bring more Centrists to the negotiating table. We also have to rate our representatives by their willingness to collaborate and compromise. Not by their ability to stick to the party line vehemently. Brad Porteus’ Bridge Grades substack has interesting takes on this.

Next up: Corporate Taxes and Social Security. Excited? I am!